how billionaires pass wealth

The billionaire owners of NFL. Estate tax loopholes exploited by billionaires allow them to pass their wealth onto their heirs without paying taxes.

The American Express Centurion Black Card Infographic American Express Centurion American Express Black Card American Express Card

The Hidden Ways the Ultrarich Pass Wealth to Their Heirs Tax-Free An inside look at how Nike founder Phil Knight is giving a fortune to.

. Bloomberg Businessweeks Mark Leydorf reads Hidden Ways the Ultrarich Pass Wealth to. For instance if a billionaire began the year with 10 billion in wealth and ended the year with 11 billion the tax would impact the 1 billion. 1 day agoContrasting data from the WAS with that from sources like the Sunday Times Rich List or the Forbes Billionaire List provides much deeper insights into the wealth of the top 1 percent perhaps because the wealthy are more honest with sources that arent connected with the state. Nike founder Philip Knight is a prime example of someone who has employed a number of strategies over the past decade.

Pass the Billionaire Wealth Tax 26 Oct 2021 at 834 pm Defending the Billionaires Income Tax 26 Oct 2021 at 652 pm I dont want to add to my personal net worth at the expense of my fellow Americans. Their net worth grew by more than 36 trillion in 2020 alone boosting their share of global household wealth to 35. Mike Bloomberg paid 707 million in. Hes hardly the only American billionaire to take advantage of.

The Hidden Ways the Ultrarich Pass Wealth to Their Heirs Tax-Free October 21 2021 Officially gifts are taxable. Global billionaires last year enjoyed the steepest increase in their share of wealth since the World Inequality Lab began keeping records in 1995 according to the research groups analysis released Tuesday. Or perhaps simply because of a vain desire to be as close to. The proposal aims to upend how the wealthiest 01 of Americans pass on their fortunes tax-free.

Inquiring minds want to know what the ultra-rich can still do under todays tax law to transfer wealth to loved ones without getting hosed. Estate tax loopholes exploited by billionaires allow them to pass their wealth onto their heirs without paying taxes. The past decade of record-low interest rates rising asset prices and ever-looser tax rules has made this an historically ideal time for the top 01 to pass wealth to their heirs. How the 01 Dodge Estate Taxes.

It would leave in place the stepped-up-basis loophole in the estate tax which allows billionaires to pass on their fortunes without paying any tax on unrealized capital gains. In all UBS and PwC estimate that 40 of the billionaires they track are over 70 and will likely pass on their wealth by 2040. Billionaires representing 11. Billionaires have seen their total wealth increase by 21 trillion a gain of 70 percent.

How American Billionaires Pass Wealth to Heirs Tax-Free. October 21 2021 at 814 am by Breaking News. The secret to how Americas wealthiest households create dynasties and pay less estate taxes than they should is through the Grantor. Dynastic wealth when families pass money down from one generation to the next is a problem in America according to Warren Buffett.

Billionaire Family Wealth. The Hidden Ways the Ultrarich Pass Wealth to Their Heirs Tax Free. These trends have turned once-minor loopholes in the tax code into gaping flaws. House Democrats Tax Plan Includes 265 Top Corporate Rate By.

The ultrarich have an ever-increasing array of tools at their disposal that enables them to. After all the current estate tax exemption threshold is only 1158 million per person in 2020 and every dollar passed down after that is taxed at a 40 rate. The commissioner of the league Roger Goodell said to be paid 40 million a year although that has been bolstered by bonuses the last two years. How the Ultrarich Pass on Wealth Tax-Free.

Ever wonder how multi-millionaires and billionaires avoid paying estate taxes when they die. That breaks down to 48 of the US. Warren Buffett who has called for tougher tax rules for the wealthy paid under 24 million in taxes between 2014 and 2018. Nike founder Philip Knight is a prime example of someone who has employed a.

A case study showing how the estate tax is entirely avoidable. If you send someone more than 15000 per year youre supposed to file a separate gift tax return with the total counting toward your 117 million lifetime estate-and-gift-tax exemption. Since the beginning of the pandemic 745 US.

8 Rags To Riches Stories How These Millionaires Billionaires Became Wealthy Physician On Fire Video Video In 2021 Rags To Riches Stories Budgeting Finances Wealth Affirmations

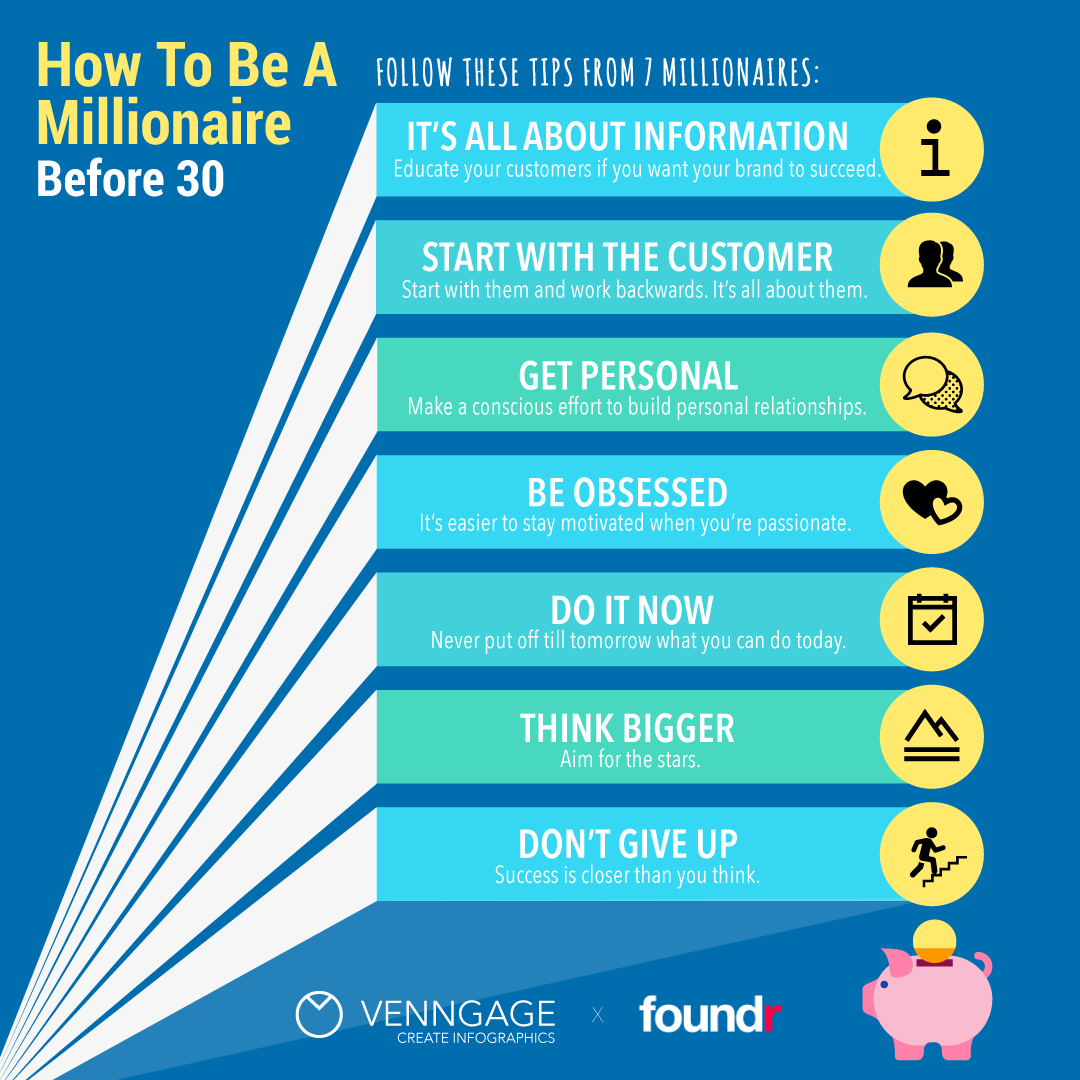

How To Become A Millionaire Before Age 30 Millionaire Become A Millionaire How To Become

Digital Book From Nyt Bestselling Author Garrett Gunderson Reveals How The Wealthy Get And Stay That Way And Digital Book Billionaire Books Wealth Planning

How American Billionaires Like Phil Knight Pass Wealth To Heirs Tax Free In 2021 Wealth Tax Free The Heirs

Billionaire Behavior Self Made Billionaires Secrets Billionaire Behaviors Traits Of Billionaires M Self Made Millionaire Personal Success Millionaire Minds

Posting Komentar untuk "how billionaires pass wealth"